Why 80% of Traders Fail - And How a Journal Can Save You

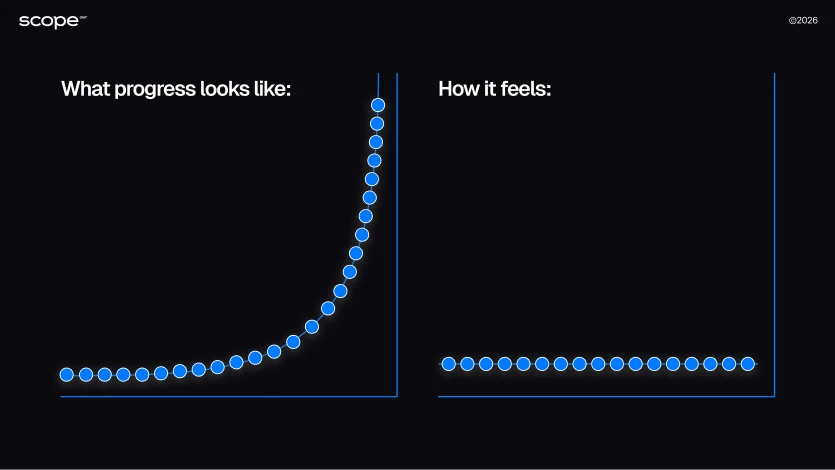

Most beginner traders make one critical mistake - they focus exclusively on theory, backtesting, and the search for the “perfect” strategy, forgetting about the most important element of successful trading.

We’re talking about the trading journal - the tool that determines a trader’s future.

Statistics show that more than 80% of traders lose money in their first year. But among those who keep a detailed trading journal, the percentage of successful ones is significantly higher.

Coincidence? Hardly.

What is a trade journal and why is it needed?

A trading journal is a structured overview of trading results. It includes not only tracking basic information about trades: time, volume, entry and exit prices, and profits, but also the motives behind decisions, emotional state, and market context.

Who needs a trade journal?

Beginners in trading (up to 1 year in the sphere)

Beginning traders often find themselves in a vicious cycle of repeating the same mistakes. Without systematic analysis, they may repeat the same mistakes for months without understanding the reasons for their losses. A trading journal becomes a tool for rapid learning, allowing them to identify weaknesses in their strategy and psychology within the first few weeks of trading.

For example, a beginner may discover that most of their losses occur when trading against the trend or on weekends. These insights help to form the right trading habits from the very beginning, saving months of painful trial and error learning.

Mid-level traders (1 year or more in the sphere)

Experienced market participants use the journal to fine-tune their trading systems. At this stage, it is not radical changes that are important, but point improvements that can significantly increase profitability.

Detailed analysis allows optimizing strategy parameters: adjusting position sizes, improving entry and exit timings, identifying the most profitable market conditions. It often turns out that minor adjustments in the approach can increase annual returns by 10-20%.

Professional managers and institutional traders

For professional traders, keeping a detailed journal is not just a useful practice, but a mandatory requirement. Asset managers must provide detailed reporting to investors, explaining the logic behind each decision and the results of trading activities.

In addition, institutional trading requires strict adherence to risk management and compliance procedures*. The trading journal serves as proof that all transactions were carried out in accordance with the approved strategy and within the established risk limits.

* Compliance procedures in trading refer to a set of measures and rules designed to ensure that a firm’s activities - and those of its clients - comply with legal regulations, industry standards, and internal policies. These include client identity verification (KYC), risk assessments, transaction monitoring, and ethical conduct enforcement to prevent financial crimes, money laundering, tax evasion, and other violations.

Regardless of the level of experience and scale of trading, the journal remains a universal tool for professional growth. The only difference is the depth of analysis and the complexity of the metrics used. But the principle is the same - unless you understand your own actions, you cannot improve them.

Why do you need to keep a trade journal?

Identification of statistically significant patterns

Large sets of trading data contain hidden patterns that cannot be detected intuitively. A systematic analysis of a 6-12 month journal can reveal:

Temporal anomalies: Many traders find that their performance varies significantly depending on the time of day. For example, trades opened in the first 30 minutes after important economic news can show a 20-30% lower than average winrate due to increased volatility and emotional decision making.

Correlations: Analysis can show unexpected correlations, for example, that the profitability of EUR/USD trades correlates with the DXY index or that position size is inversely proportional to entry quality.

Seasonal effects: Detailed records can reveal that certain strategies perform better in specific quarters, months or days of the week, which is related to institutional cycles and the behavior of major players.

Developing trading discipline

The journaling process creates an additional layer of reflexivity between the impulse to make a trade and its actual execution. Knowing that every decision will be documented and analyzed activates the prefrontal cortex, the area of the brain responsible for rational thought and impulse control.

This leads to the formation of the habit of asking yourself key questions:

Does this trade fit my trading plan?

Can I clearly formulate a hypothesis about the price movement?

What is the ratio of potential risk to profit?

In what emotional state am I making this decision?

Quantitative Optimization of Trading Systems

A trading journal transforms subjective impressions into objective metrics, enabling the use of quantitative analysis methods to improve performance:

Statistical hypothesis testing

You can evaluate whether certain strategy modifications actually lead to better outcomes using t-tests and other statistical tools.*Optimization of risk management parameters

Accurate journal data allows you to calculate optimal position size using the Kelly formula**, as well as determine the most effective stop-loss and take-profit levels under different market conditions.Segment analysis

Breaking trades down by category (instruments, time of day, volatility, trend direction) helps identify which segments of your trading are the most and least effective.Predictive modeling

With a sufficient amount of high-quality data, you can build machine learning models*** to forecast the probability of success in future trades based on historical patterns.

* A t-test (Student’s t-test) is a statistical method used to compare the means of two groups and determine whether the observed difference is statistically significant.

** Kelly % = W - [(1-W) / R]

Where:

Kelly % (or F) is the portion of capital to invest per trade;

W is the win probability (between 0 and 1);

R is the average win-to-loss ratio (average profit divided by average loss).

*** Algorithmic trading (or algo trading) is a method of executing trades using computer algorithms that automate decision-making and order execution based on predefined rules.

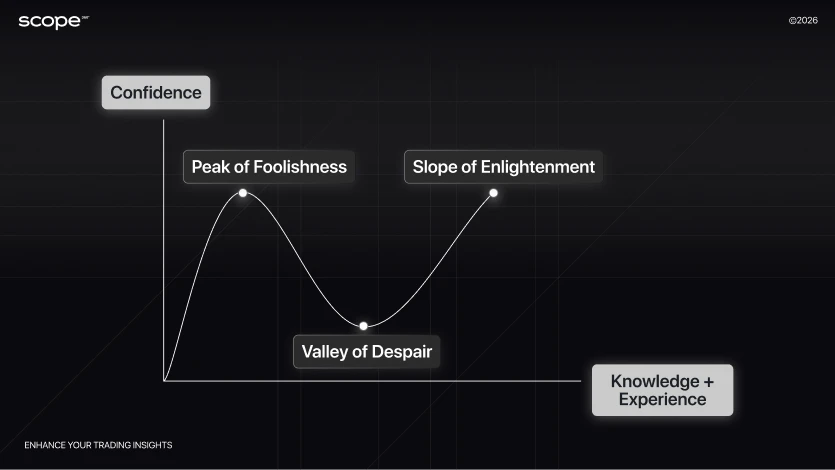

Psychological profiling and working with emotions

An extended trading journal that includes a record of emotional state becomes a tool for psychological introspection. The correlation between emotional states and trading results often provides startling insights:

Trades made in a state of euphoria after a series of profits perform worse due to neglect of risk management

Trading under stress or fatigue leads to a 40-50% increase in errors

Certain emotional triggers (e.g., missing a profitable opportunity) provoke a chain of irrational decisions

These data allow us to develop personalized protocols for managing psychological well-being and create a warning system for potentially dangerous periods for trading.

How to keep a trade journal correctly: structure, categories and key data

To make a trading journal really useful, it is important to record not only numbers, but also the logic of actions. Below is a basic structure that will suit both a novice trader and an experienced specialist.

1. What data must be recorded in the transaction journal

Record basic information for each position:

date and time of trade opening/closing;

trading instrument and direction (long/short);

position volume;

entry and exit price;

result: in points, percent and currency.

This information allows you to track statistics and objectively evaluate trading efficiency.

2. Market context: how to capture the conditions in which you opened a deal

Context is an important part of analysis. Indicate:

trend on senior and junior timeframes;

support and resistance levels near the trade;

economic events or news;

the level of volatility at the time of entry.

This will help you understand how market conditions affect your decisions and results.

3. Analyzing a trade: what to write down besides the numbers

A good trader tracks not only the result, but also the reasons:

the trade idea and the reason for the entry;

the strategy or set-up on which the trade was made;

planned risk/profit ratio (R:R);

emotional state at the moment of position opening.

These records allow you to identify where you are acting according to a system and where you are being influenced by emotions or impulses.

4. Evaluation and classification of transactions: why it is necessary and how to conduct it

Add 2 simple mechanisms to the journal:

Evaluate trade execution - from 1 to 5, regardless of PnL. It will help to distinguish qualitative realization from random luck.

Classification of the deal - by type: trend, countertrend, breakout, rebound, etc. This will show in which conditions you trade most effectively.

5. Examples of trading journal structures and templates for a trader

You can adapt the journal to your level and trading style. The main thing is not to overload the system at the start, but also not to limit yourself to basic metrics if you want to develop.

A minimal trading journal template for beginner traders

If you are just mastering trading, start with a simple and clear format. Such a template will help you form a basic discipline and learn to analyze each trade.

Date/Time | Instrument | Entry | Exit | Result | Reason for Entry | What Worked / Did Not Work Out |

07/15/2025, 2:30 pm | EUR/USD | 1.0950 (buy) | 1.0980 (manual close) | +30 pips, +$150 | Rebound from 1.0945 support | Correctly identified the level, but exited too early |

07/16/2025, 11:00 am | BTC/USD | 63,500 (sell) | 62,800 (manual close) | +$700 | Resistance at 63,550 rejected | Good timing on entry, but missed larger potential downside |

This format allows you to track trades, reasons for entry and the simplest conclusions without unnecessary load. This is already enough to notice basic mistakes and start forming a trading system.

Advanced template for advanced traders

For experienced traders, it is important to consider not only the fact of the trade, but also the deeper context. In this case, you can add to the template:

analysis of several timeframes (multi-timeframe view);

correlations with other instruments (e.g. indices or commodities);

assessment of market sentiment (crowd sentiment, positioning);

psychological notes: confidence level, emotions before/after the deal;

screenshots of charts with entry and exit zones for visual archive.

This additional information makes it possible to move from tactical analysis to strategic analysis - to track not only individual trades, but also the general approach to trading.

Weekly and monthly review: why it is needed and how to maintain it

A journal is not only a recording tool, but also a basis for regular analysis. Once a week or month it is recommended to summarize the key parameters:

total profitability for the period;

number of profitable and losing trades;

average profit and average loss;

maximum drawdown;

cases of violation of the trading plan;

conclusions on strategies and behavioral mistakes;

plans for the next trading period.

Such a review allows you to go beyond one-off trades and evaluate performance over a distance. It is the key to conscious growth and adaptation to the market.

Modern solutions

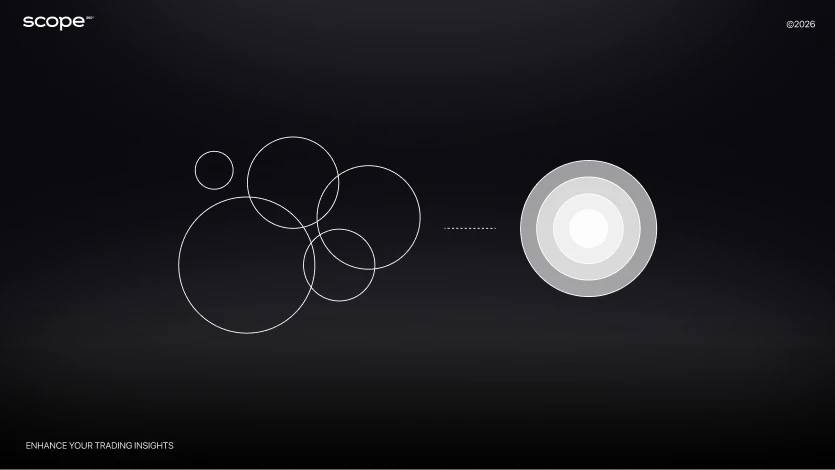

Keeping a detailed journal manually is a labor-intensive and monotonous process. Many traders start with enthusiasm, but after a few weeks they give up this practice. This is where automated solutions come to the rescue.

Challenges of manual logging

Time cost: 5-10 minutes per transaction

Human error: calculation errors, data omissions

Subjectivity: tendency to embellish or gloss over failures

Complexity of analysis: graphing and calculating metrics manually

Benefits of automated journals

Modern solutions such as Scope360° are revolutionizing the approach to trade logging:

Automatic data capture: All trades are imported directly from the exchange or broker without trader involvement. This allows you to save time by getting all the necessary information at once.

Instant analytics: The system calculates all key metrics in real time: winrate, profit factor, maximum drawdown, average profit and loss.

Data visualization: Interactive charts and widgets help you quickly identify trends and patterns in trading.

Advanced segmentation: Automatic categorization of trades by instruments, time periods, and position sizes allows for detailed performance analysis.

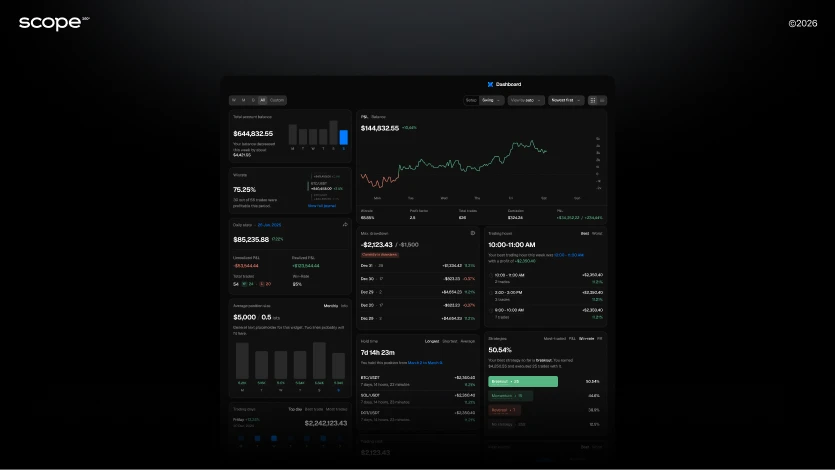

What is Scope360°?

Scope360° is the next step in the development of the trading journal. The platform replaces the routine of manual accounting with a system that runs in the background, automatically collects data and helps the trader focus on making decisions rather than documenting them.

Instead of spreadsheets and scripts, the user gets:

automated synchronization of deals via API;

visual dashboards and analytics on key metrics (PnL, R:R, winrate, MAE/MFE);

Deal tagging, emotion and behavioral pattern tracking;

recommendations for improvement based on personal statistics;

access to aggregated anonymous statistics of other traders.

The platform is available on desktop and as a mobile app App Store and Google Play., allowing you to capture and analyze transactions at any time.

Key features of Scope360°:

Cryptocurrencies and Forex in one interface: The platform supports connection of both crypto exchanges (Binance, Bybit, etc.) and Forex accounts. All transactions are accounted for in a single system with the possibility of flexible filtering and analysis.

Full-featured mobile app: The functionality of Scope360° is not limited to the web version. Key features available in the mobile app include: viewing deals, adding notes, filtering and real-time analytics.

Flexible entry: automatic and manual: Transactions are automatically pulled up through the API, but can be added manually if needed - for test strategies, offchain activity or external reporting.

Sharing and Sharing: You can share trades or logs with mentors, peers, or a team. Comments and collaborative analysis are supported.

Portfolios and multi-account: The ability to group accounts and exchanges into logical portfolios: by strategy, market or activity type. Separate analytics, comparison and dashboard are available for each portfolio.

Additional features:

Filtering by tags, strategies and emotions: Analyze trades by specific attributes: FOMO, "early exit", "impulse entry", timeframe, session, setup type. All of these can be quickly searched and compared.

Monitoring discipline and deviations from the plan: Scope360° captures instances of strategy violations, deviations from the plan, and emotional reactions. This helps to objectively evaluate not only the result, but also the decision-making process.

Comparative analytics with other traders (anonymized): You can see how your performance compares to the platform average - this gives you an additional point of reference when analyzing.

Scope360° is a platform that doesn't just capture trades, but helps you see patterns, monitor behavior, and make more accurate decisions.

It allows you to focus on what's important - making trading decisions, not on keeping records.

Conclusion

Successful trading is about consistency, objectivity, and constant feedback. A trading journal is a tool that combines all three elements into a single decision-making system.

With its help, you cease to be a participant in chaos and begin to act as an analyst: observing yourself, drawing specific conclusions, adapting your strategy, and developing discipline. Over time, this becomes your built-in practice - an integral part of a professional approach.

Yes, you can start with a spreadsheet. But if you are results-oriented, sooner or later you will need a tool that works faster, deeper, and more accurately.

Scope360° It is an infrastructure for growth: automation, visualization, depth of analysis, multi-account, mobile access, and honest statistics in one click.

Open Scope360° and see what a journal that works as part of your strategy looks like.