You can have the best market analysis in the world, but if you don't understand trading mechanics, you will lose money. Execution is the bridge between your idea and your profit.

Many beginners focus solely on "where the price is going." Professionals focus on "how to enter the trade efficiently."Advanced traders go one step further - they track and fix their execution decisions in a trading journal.

1. Understanding Order Types

When you click "Buy" or "Sell," you are sending an instruction to the exchange. The way you send that instruction determines your price and your fees.

Market Orders vs. Limit Orders

This is the most fundamental distinction in trading.

Feature | Market Order | Limit Order |

Definition | Executes immediately at the current best available price. | Executes only at a specific price (or better) that you set. |

Priority | Speed. You want to get in/out now. | Price. You are willing to wait for your price. |

Guarantee | Guaranteed execution, but price may vary (Slippage). | Guaranteed price, but execution is not guaranteed (Price may not reach it). |

Fee Type | Taker Fee (Usually higher). | Maker Fee (Usually lower or zero). |

Pro Tip: In crypto futures trading, "Maker fees" (Limit orders) are often 50% cheaper than "Taker fees" (Market orders). Over 1,000 trades, using Limit orders can save you thousands of dollars.

Stop Orders

A Stop-Loss is a mechanism that triggers a market order once the price hits a certain level. It is your emergency brake.

Stop-Limit: Triggers a limit order when a price is hit (Safer price, risk of not filling).

Trailing Stop: A dynamic stop-loss that follows the price as it moves in your favor, locking in profits automatically.

2. Leverage and Margin Explained

In markets like Crypto Futures and Forex, trading with your own capital alone is rare. Most traders use Leverage.

Leverage allows you to control a large position with a small amount of capital. It acts as a multiplier for both your profits and your losses.

Margin: The actual money you put up to open the trade (Collateral).

Leverage: The borrowed funds from the exchange.

How Leverage Works (The Math)

Imagine you have $1,000 in your account and you want to trade Bitcoin using 10x Leverage.

Your Margin: $1,000

Total Position Size: $10,000 ($1,000 $\times$ 10)

If Bitcoin moves up by 5%:

Without Leverage: You make $50 (5% of $1,000).

With 10x Leverage: You make $500 (5% of $10,000). That is a 50% ROE (Return on Equity).

The Dark Side: Liquidation

Leverage is a double-edged sword. If the price moves against you, your losses are also multiplied.

If you use 10x Leverage, a 10% move against you wipes out your entire collateral ($10\% \times 10 = 100\%$). This is called Liquidation.

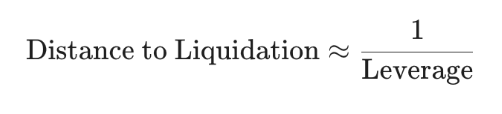

The formula for estimating the liquidation distance (for Long positions) is roughly:

10x Leverage: Liquidation at $\approx 10\%$ drop.

50x Leverage: Liquidation at $\approx 2\%$ drop.

100x Leverage: Liquidation at $\approx 1\%$ drop (Extremely risky).

Warning: High leverage is the #1 reason beginners blow up their accounts. Professional traders rarely use more than 3x-5x leverage on volatile assets like Crypto.

Short SellingTrading mechanics also allow you to profit when markets fall. This is called Shorting.

You borrow an asset to sell it at the current high price, hoping to buy it back later at a lower price and pocket the difference.

Long: Buy Low $\rightarrow$ Sell High.

Short: Sell High $\rightarrow$ Buy Low.

3. The "Silent Killers" of Profit: Spread, Slippage and Fees

Many beginners look at a chart, see a 1% move, and think: "If I catch this, I make 1%." Wrong. You make 1% minus the costs. In high-frequency trading or scalping, these costs can eat up to 50% of your profits.

The Bid-Ask Spread

The market price is not a single number. It is an auction.

Bid: The highest price a buyer is willing to pay.

Ask: The lowest price a seller is willing to accept.

The Spread: The gap between them.

Why it matters: When you execute a Market Buy order, you pay the (higher) Ask price. If you immediately sell, you get the (lower) Bid price. You effectively start every trade with a small loss. On illiquid altcoins, this spread can be huge.

Slippage

Slippage happens when there is high volatility. You click "Buy" at $100, but the price moves so fast that your order gets filled at $100.50.

Positive Slippage: You get a better price (rare).

Negative Slippage: You get a worse price (common).

Funding Fees (Crypto Specific)

If you trade Perpetual Futures (the most popular crypto instrument), you pay a Funding Fee every 8 hours. This is a fee paid between Longs and Shorts to keep the futures price close to the spot price.

Warning: During bull runs, funding rates can get very high. Holding a long position can bleed your account even if the price stays flat.

4. From Theory to Practice

How do you master these mechanics without going broke?

Step 1: Paper Trading (Demo)

Start with a demo account. Your goal here is not to make virtual millions. It is to learn the interface:

How to set a Stop-Loss correctly.

How to calculate position size.

How to avoid "fat finger" errors (clicking the wrong button).

Step 2: Go Live with Small Size

Paper trading has one flaw: No Emotion. Once you understand the buttons, switch to a real account with a very small amount (e.g., $100). You need to feel the psychological pressure of risking real money.

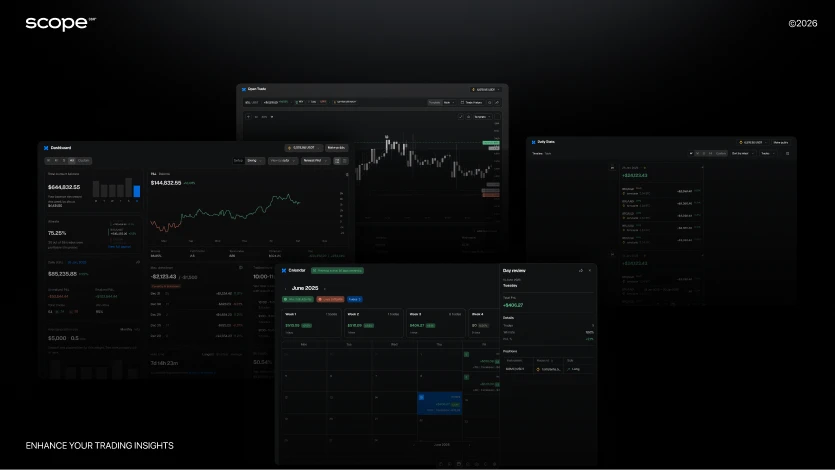

Step 3: Track Your "Net" PnL with Scope360

Exchanges often show you your "Gross Profit" (Dirty PnL) and hide the fees in the transaction history. You might think you are profitable, but after fees and funding, you might be breaking even.

This is where Scope360.io is essential. It automatically subtracts all commissions, funding fees, and rebates to show you your True Net PnL.

Visualize Fees: See exactly how much you paid in fees this month.

Analyze Execution: Did you enter too late? Did you exit too early?

Journaling: Link your mechanical execution to your psychological state.

Conclusion

Trading mechanics are the rules of the game. Leverage gives you power, order types give you control, and understanding fees gives you an edge.

Don't let hidden costs eat your edge. Master the mechanics, start small, and use professional analytics to keep your trading honest.

Ready to see your True PnL?

Connect your exchange API to Scope360 and start treating your trading like a business pro.

Start your free trial now and see real impact on your trading decisions.