How Not to Mess Up at the Start: Why Every Beginner Needs a Trading Journal

You open the terminal. The charts look promising. You take a trade - it wins. You feel great. You take another one - loss. Then another - loss. By Friday evening, your account balance is down, your head is spinning, and you can’t remember why you entered that third trade on Tuesday. Was it a breakout? A hunch? Or just boredom?

If this sounds familiar, welcome to the club. Every trader starts here.

When you are new, everything feels like chaos. You are bombarded with signals, patterns, and emotions. Trying to keep it all in your head is a guaranteed way to burn out (and blow your account).

The difference between a gambler and a professional trader is not luck. It’s data.

A trading journal is the only tool that turns that chaos into a structure. It doesn’t just track your money - it tracks you. In this guide, we’ll explore why a journal is your safety net in those first critical months and how Scope360° helps you build one without drowning in spreadsheets.

What a Trading Journal Really Is (and What It’s Not)

Let’s clear up a misconception immediately: A trading journal is not just a list of wins and losses.

If you are only writing down "Bought BTC at $60k, Sold at $62k, made $200", you are doing accounting, not journaling. Accounting tells you what happened. Journaling tells you why.

Think of a trading journal as a feedback loop. It connects three things:

The Setup: What you saw in the market.

The Execution: How you managed the trade and risk.

The Psychology: How you felt while doing it.

It is not a place to brag about profits - it is a laboratory where you dissect your decisions. Whether you use a notebook or an automated tool like Scope360°, the goal is the same: to stop making random bets and start executing a business plan.

Why Beginners Blow Up Without Journaling

Here is a hard truth: Most beginners don't lose money because they don't know technical analysis. They lose money because they don't know themselves.

Without a journal, your trading brain is full of cognitive biases.

Selective Memory: You remember that one massive win but conveniently forget the five small losses that wiped it out.

Revenge Trading: You lose a trade, get angry, and immediately double your size to "make it back." Without a journal to flag this behavior, it becomes a habit.

Strategy Hopping: You try a strategy for two days, lose once, and switch to a new "guru." You never gather enough data to see if anything actually works.

A journal acts as a mirror. It shows you ugly truths like: "You lose 80% of trades taken after 8 PM" or "You always exit winners too early out of fear."

These insights are painful, but they are the only way to stop bleeding money.

Three Things a Beginner Should Log for Every Trade

You don’t need to write a novel. Complexity kills consistency. To start, focus on capturing just three core elements for every single position.

1. Entry & Context (The "Why")

Before you click buy, can you explain why?

Setup: Was it a trend pullback? A support bounce? A news play?

Trigger: What exactly made you pull the trigger right now?

2. Risk & Plan (The "How")

This is where you act like a professional risk manager.

Stop Loss: Where will you admit you were wrong?

Target: Where will you take profit?

Position Size: Is this a $50 risk or a $500 risk?

3. Emotions & Outcome (The "Who")

This is the most overlooked part.

State of Mind: Were you calm? Anxious? FOMO-ing because Twitter said "up only"?

Review: Did you follow your plan, or did you panic sell?

Pro Tip: Logging this manually takes discipline. Scope360° automates the boring stuff (entry price, time, P&L) so you can focus purely on these high-value notes.

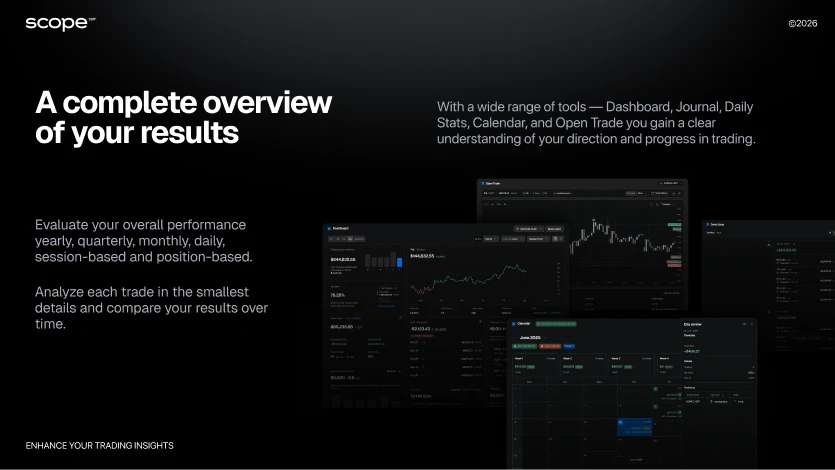

How Scope360° Helps Beginners Journal Without Drowning in Spreadsheets

The biggest enemy of a beginner is friction. If journaling feels like homework, you will stop doing it.

Many traders start with Excel. They spend hours building formulas, color-coding cells, and manually typing in numbers. Eventually, they get tired, miss a few days, and the habit dies.

Scope360° removes the friction so you can focus on the insights.

Automated Import: Connect your exchange (Binance, Bybit, OKX, or Forex brokers) via API, and your trades appear in the journal automatically. No typos, no missed data.

Visual Dashboards: Instead of rows of numbers, you see clear charts. Your Win Rate, Profit Factor, and Daily P&L are calculated instantly.

Context on Autopilot: The platform fills in the "what" (price, size, time). You just add the "why" using tags and notes.

Mobile App: Trade on your desktop, review on your phone. Add a note about your emotions while you’re walking the dog, right after closing a position.

It’s the difference between drawing a map by hand and using GPS - both get you there, but one lets you focus on driving.

Journal as a Tool for Emotions, Discipline and Real Progress

A journal isn't just a record - it's a mentor. Here is how it fixes the three biggest holes in a beginner's game.

1. Mastering Emotions (FOMO & Tilt)

You can’t fix what you can’t see. In Scope360°, you can tag a trade as #FOMO or #Revenge.

The realization: After a month, you filter by these tags and see: "Wow, I lost $400 this month just on FOMO trades."

The fix: The next time you feel that urge, you remember the cost. You stop acting on impulse.

2. Building Discipline

Discipline is simply sticking to your own rules. A journal holds you accountable.

Plan vs. Fact: You intended to risk 1%, but the journal shows you risked 5%.

Pattern Recognition: You see that you constantly break rules on Friday afternoons. Scope360°’s Calendar View lights up red on Fridays, giving you a clear signal: "Stop trading on Fridays."

3. Finding Your "Edge"

Beginners try to trade everything. A journal helps you specialize.

Filter your history by asset (BTC vs. Gold).

Filter by time of day (London Open vs. New York Close).

Filter by direction (Long vs. Short).

You might discover you are a genius at longing ETH in the morning but terrible at shorting it at night. That insight alone can turn a losing trader into a profitable one.

Key Metrics a Beginner Should Watch (Without Overcomplicating)

Data overload is real. Ignore the complex quant metrics for now. Focus on these four numbers in your Scope360° dashboard:

Win Rate: How often are you right? (Note: You don’t need 90% to be profitable. 40-50% is often enough with good risk management).

Average R:R (Risk/Reward): Are your winners bigger than your losers? If your average win is $50 and average loss is $100, a high win rate won’t save you.

Consecutive Losses: How many times in a row do you lose? This helps you size your positions so you don’t blow up during a bad streak.

Daily P&L: Not to stare at the money, but to spot volatility in your results. Consistency is a smooth line, not a rollercoaster.

Conclusion: Stop Guessing, Start Tracking

Trading is one of the hardest skills to learn because the feedback loop is often broken. You can make a bad decision and make money (luck), or make a good decision and lose money (probability).

Without a journal, you will never know the difference.

You don’t need to be a math wizard or a spreadsheet expert. You just need to be honest with yourself. Scope360° makes that honesty easy, automated, and visual.

Your Next Step:

Don’t wait for the "perfect" time.

Register for Scope360° (it takes 2 minutes).

Connect your exchange account via API.

Look at your last 10 trades. Tag the ones where you felt emotional.

Start your first trading journal today, and let your next 20 trades teach you more than your previous 200.

FAQ

Q: Do beginners really need a trading journal?

A: Yes. It is the fastest way to identify mistakes and stop losing money on emotional decisions. Without it, you are learning blindly.

Q: Can I just use Excel for my trading journal?

A: You can, but manual entry is prone to errors and takes time. Automated tools like Scope360° sync trades instantly, letting you focus on analysis rather than data entry.

Q: How many trades should I log before analyzing?

A: Start analyzing immediately, but look for patterns after about 20–30 trades. This sample size helps separate luck from skill.

Q: Does Scope360° work for crypto and forex?

A: Yes, Scope360° supports major crypto exchanges (Binance, Bybit, OKX) and Forex brokers via MetaTrader 4/5 integration.