Universal spreadsheets or a trading-specific journal? An honest comparison of tools traders use in 2026.

To trade consistently and profitably, making forecasts isn’t enough - you need to understand what in your strategy actually works and what leads to losses. That’s why traders use journals.

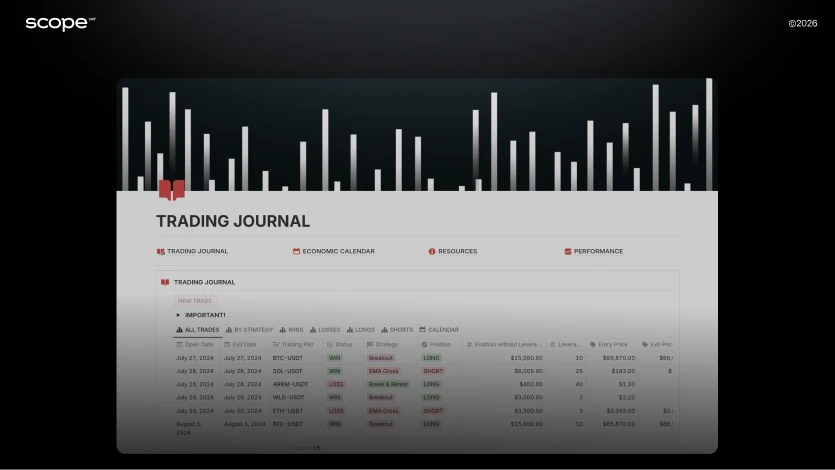

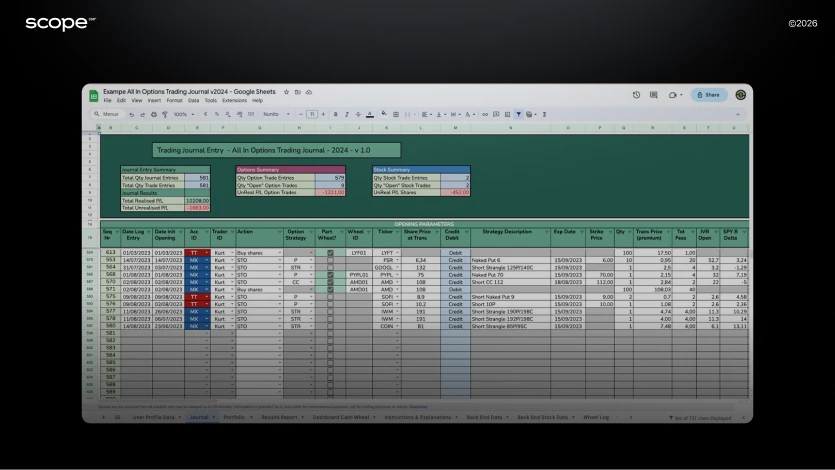

But here’s the trap: many believe that Excel, Google Sheets, or even Notion are good enough. Manual journaling may look like discipline, but in reality it turns into routine - where errors slip in, trades get lost, or stats are “cleaned up” subconsciously.

Scope360° approaches the problem differently. It’s not a universal note-taking tool or a spreadsheet - it’s a trading analytics platform: automatic trade imports, behavioral analytics, dozens of metrics, and full mobile access. In this overview, we’ll compare Scope360° with the main alternatives - Notion, Edgewonk, and Excel - to show how the choice of platform directly impacts the quality of your trading.

Scope360° vs Notion

Notion is a flexible all-in-one workspace. You can build any template, track trades manually, and even add custom formulas. But it’s still a general-purpose tool: there’s no native integration with exchanges, no automatic metrics, and no built-in risk analysis. Everything depends on manual input.

That’s where cognitive biases creep in. When you log trades by hand, it’s tempting to “clean up” mistakes, skip losses, or frame results more positively than they really are. This isn’t just laziness - it’s a well-known psychological trap in trading.

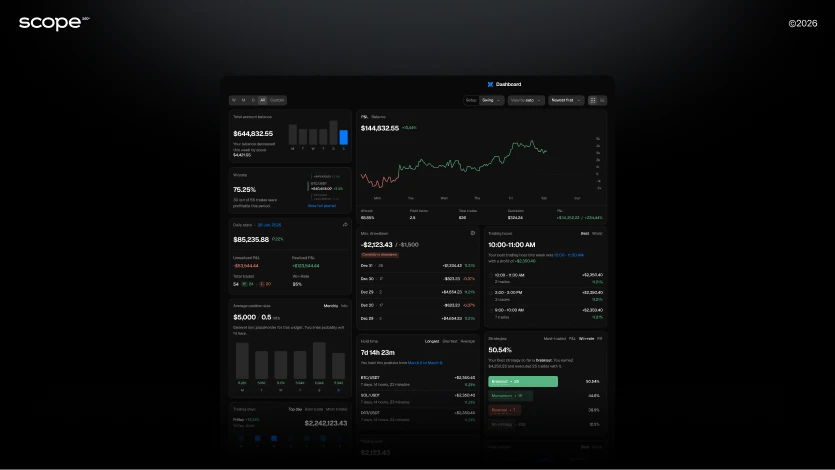

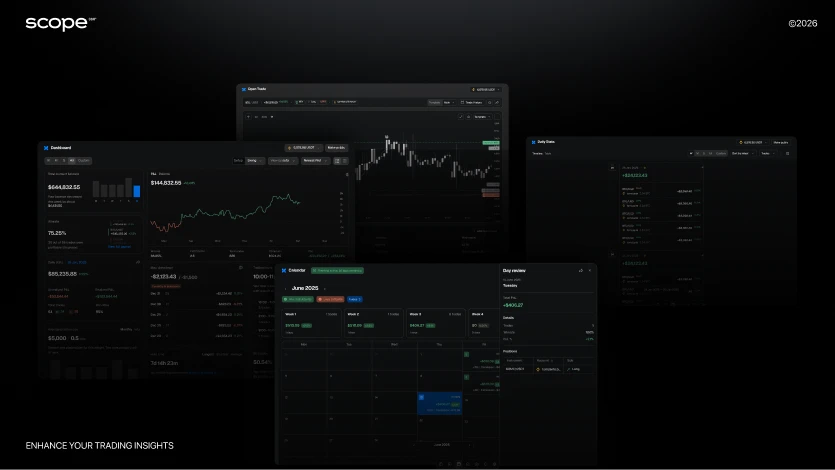

Scope360° removes that bias by design. Trades sync automatically via API from exchanges and MT4/MT5, and every execution is recorded as it happened. No cherry-picking, no missing data. On top of that, Scope360° adds what Notion can’t: real-time dashboards, MAE/MFE, drawdown tracking, tagging, and trade replays - all built specifically for traders.

Summing up, Notion is great if you want to build everything from scratch. Scope360° is for traders who want ready-made structure, reliable stats, and automation that keeps psychology out of the data.

Scope360° vs Excel

Excel and Google Sheets are the first thing traders choose. Each trade requires manual entry, formulas must be set up manually, and charts quickly break as the database grows. Moreover, spreadsheets don’t account for real costs - commissions, swaps, slippage. As a result, the numbers on the screen often differ from what’s actually in the account. Free, familiar, flexible. But they are universal tables: there’s no auto-import of trades, no ready-made metrics, no analysis tools. Everything relies on manual input and formulas.

Here comes a classic trap - the survivorship bias. In spreadsheets, it’s easy to remove losing trades, leave only “pretty” data, and subconsciously embellish the result. In the end, a trader doesn’t see the full picture, only the convenient part of it.

* Survivorship bias is a systematic cognitive bias in which a trader evaluates their strategies and skills based solely on successful trades, excluding unsuccessful positions and missed opportunities from their analysis.

Scope360° takes care of this routine stuff. Trades are imported automatically, and the system immediately calculates Net PnL, win rate, drawdowns, and other metrics. Dashboards put everything together in one view, and history is stored centrally - even if the exchange wipes old data.

Summing up, Excel can work as a temporary solution. Scope360° is for those who want accurate statistics, automation, and analytics that really drive results.

Scope360° vs TradeZella

TradeZella is a trading journal familiar to many for stocks, options, and futures. It’s a long-standing player in the market that many traders have used over the years: basic metrics, trade notes, and simple filters - all of this helps to get started and record results.

But in 2026, traders need a platform that evolves with the market: less manual routine, more precise metrics, regular updates, and modern analysis tools - without unnecessary workarounds.

Scope360° keeps up with modern trends. A unified journal for crypto, forex, and spot, automatic import via API (exchanges and MetaTrader), 50+ metrics per trade, interactive dashboards and calendar, tags and behavioral notes, full iOS and Android apps. Plus - a focus on regular updates and new modules, including a built-in AI assistant for quick reviews and spotting patterns.

TradeZella remains a convenient basic journal. But if you want a tool that keeps up with the times and covers the entire cycle - from recording to analysis and improvement - Scope360° delivers that level straight out of the box.

Scope360° - a platform that grows with the trader

Most journals just record trades. Scope360° goes further: it’s an environment where traders get the full cycle - from data import to behavioral analysis and identifying growth points.

Everything in one place

Unified journal for crypto, forex, and spot. No more splitting records across different files and services.

Automatic import via API (Binance, Bybit, OKX, MT4/MT5). Trades are pulled in automatically, with no manual entry or errors.

Centralized history: even if an exchange wipes old data, it remains available in Scope360°.

Depth of analysis

50+ metrics per trade: Net PnL, Winrate, MAE/MFE, Profit Factor, Drawdown, and more.

Interactive dashboards and calendar: dynamics by days, sessions, and strategies.

Tags and filters: sort by setups, error types, trading sessions, instruments.

Max Drawdown: risk control by day, week, month, and quarter.

Behavioral analytics

Emotions and notes: Scope360° helps track FOMO, mistakes, and behavioral patterns.

AI assistant: highlights weak spots in strategy, helps quickly find reasons for drawdowns, and improves the process.

Modern format

Web + mobile apps (iOS and Android). All stats always at hand.

Regular updates: new integrations, features, and tools to keep up with the market.

Security: read-only access only, with no ability to manage funds.

Key point: Scope360° doesn't just keep a journal, it creates feedback that develops strategy.

Conclusion

Trading isn’t just forecasts and executions - it’s constant work on yourself and your strategy. Spreadsheets and generic tools hit a ceiling quickly: they record, but they don’t help you grow. Scope360° gives you something else - transparency, honest stats, and analytics that drive progress.

In 2026, traders don’t have time for manual routines. You need a tool that syncs automatically, shows the full picture, and helps you make faster decisions. Scope360° is built exactly for this: to make every trade a win not only in results, but in experience.

Try it for free and feel the difference from your very first sync.